The Facts About Mortgage Broker In Melbourne Revealed

Table of ContentsWhat Does Melbourne Broker Mean?Excitement About Unicorn Financial ServicesThe Ultimate Guide To Refinance MelbourneThe 2-Minute Rule for Home Loan Broker MelbourneUnicorn Financial Services - An Overview

A professional mortgage broker originates, discusses, as well as refines property as well as business mortgage in support of the client. Below is a 6 factor guide to the solutions you need to be supplied and also the assumptions you ought to have of a competent home mortgage broker: A home loan broker uses a variety of home loan from a variety of various lenders.A home mortgage broker represents your rate of interests instead of the interests of a lending institution. They need to act not only as your agent, however as an experienced consultant and issue solver. With accessibility to a large range of home loan products, a broker has the ability to offer you the best value in regards to rates of interest, payment quantities, as well as funding products (mortgage brokers melbourne).

Numerous scenarios demand greater than the easy usage of a thirty years, 15 year, or flexible rate mortgage (ARM), so ingenious mortgage techniques as well as sophisticated solutions are the benefit of collaborating with a seasoned home loan broker (https://usabizlists.com/mortgage-broker/unicorn-financial-services-springvale-victoria/). A home loan broker browses the client via any kind of situation, managing the process and also smoothing any type of bumps in the road in the process.

Borrowers that locate they need bigger car loans than their bank will certainly accept also benefit from a broker's understanding and capability to effectively acquire financing. With a home mortgage broker, you only require one application, as opposed to finishing types for each individual lender. Your home loan broker can supply a formal contrast of any type of finances suggested, assisting you to the information that precisely depicts cost differences, with existing rates, points, as well as closing prices for each and every loan reflected.

4 Easy Facts About Mortgage Brokers Melbourne Shown

A reputable mortgage broker will certainly divulge how they are spent for their services, in addition to detail the overall prices for the loan. Individualized solution is the setting apart element when selecting a mortgage broker. You ought to expect your home loan broker to assist smooth the method, be readily available to you, and also advise you throughout the closing process.

Functioning with a home loan broker can potentially conserve you time, effort, and also money. A home loan broker might have far better and also much more access to loan providers than you have.

The Definitive Guide to Refinance Melbourne

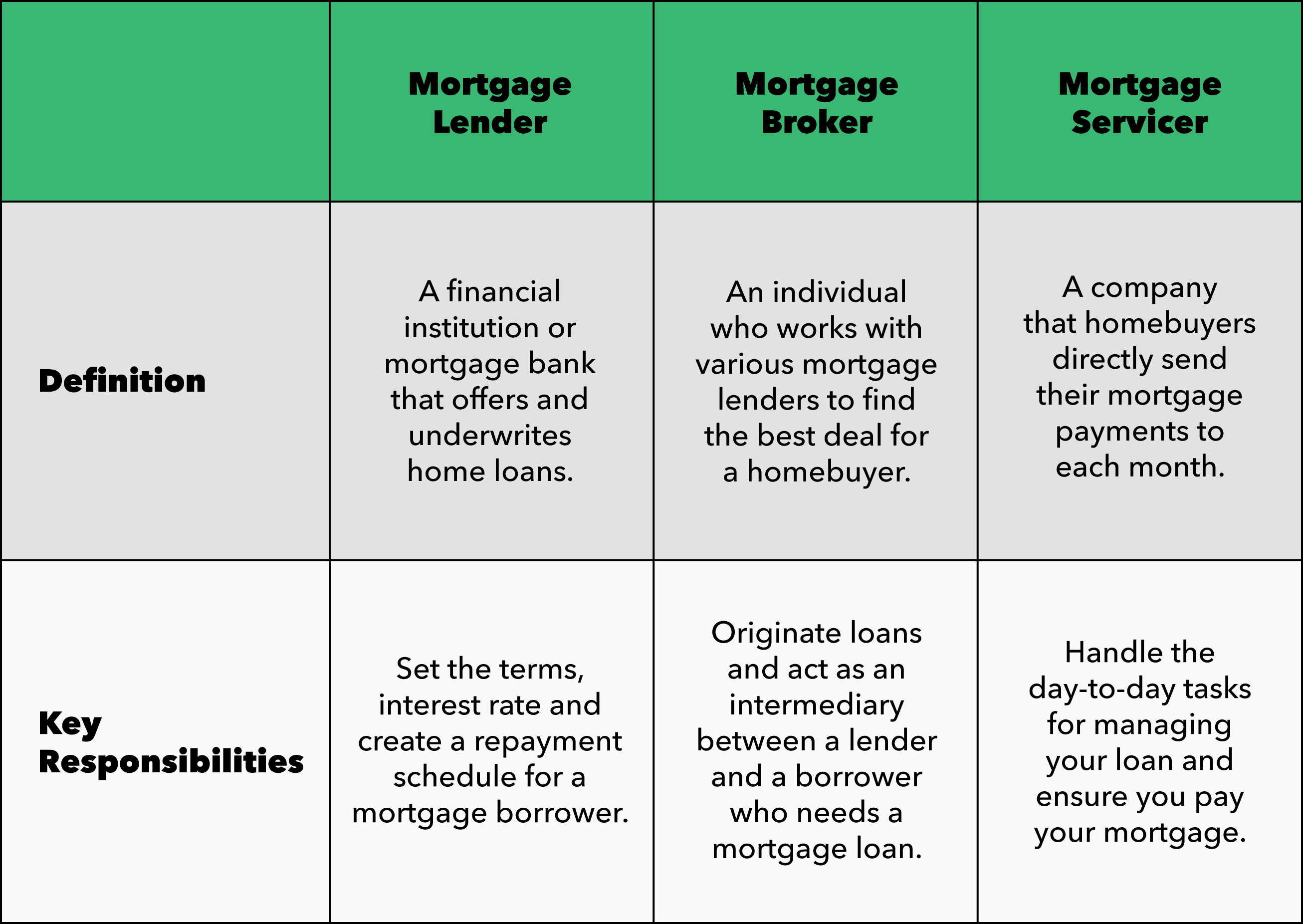

A mortgage broker executes as intermediator for a banks that offers fundings that are safeguarded with realty and individuals that desire to acquire property as well as need a loan to do so. The home loan broker functions with both consumer and lending institution to get the debtor accepted for the loan.

A mortgage broker normally collaborates with various lending institutions and also can offer a selection news of financing alternatives to the consumer (https://a1bizlistings.com/mortgage-broker/unicorn-financial-services-springvale-victoria/). A debtor does not need to work with a home loan broker. They can function straight with a lending institution if they so select. A lender is a financial establishment (or specific) that can offer the funds for the property deal.

While a home loan broker isn't required to help with the transaction, some lending institutions may only work via home mortgage brokers. If the lending institution you like is amongst those, you'll require to make use of a home loan broker.

They're the person that you'll deal with if you come close to a lending institution for a funding. The loan policeman can assist a borrower understand and also pick from the fundings offered by the lender. They'll respond to all inquiries, assist a borrower get pre-qualified for a car loan, and aid with the application process.

The Greatest Guide To Home Loan Broker Melbourne

Home loan brokers do not provide the funds for finances or authorize funding applications. They aid people seeking mortgage to find a lender that can fund their residence acquisition. Beginning by ensuring you recognize what a home mortgage broker does. Ask good friends, family members, and also business acquaintances for referrals. Take an appearance at on the internet reviews as well as inspect for grievances.

Inquire about their experience, the precise assistance that they'll provide, the costs they bill, and just how they're paid (by loan provider or consumer). Additionally ask whether they can aid you specifically, offered your particular financial situations.

Faced with the issue of whether or not to use a mortgage broker or a loan provider from a financial institution? When you are looking to buy a house, however, there are 4 key aspects that mortgage brokers can provide you that the loan providers at the financial institution just can not.

At Eagle Home loan Firm, individual touch is something we satisfaction ourselves in. You get to work with one of our agents personally, who has years of experience and can address any type of concerns you might have.

The Definitive Guide to Home Loan Broker Melbourne

Banks, on the various other hand, have a restricted schedule. Their hrs of operation are typically while you're currently at job. That has the time for that? Not to state, every vacation is a national holiday. Get the individual touch you deserve with a home mortgage broker that cares! The versatility a home mortgage broker can supply you is just one more factor to avoid going to the bank.